Unveiling the Cryptocurrency Payment Ecosystem

A full primer on cryptocurrency payments, with investor thoughts provided along the way.

This article was written by Justin from UOB Venture. Special thanks to Transak and Arf for providing their inputs and feedback along the way.

1.0 Introduction

When Bitcoin was first introduced in 2008, it was touted as a new mode of payment. The cryptocurrency could be transferred instantaneously without the need of a central approver, away from the clutches of a central authority.

Today however, cryptocurrencies and traditional payments have become more intertwined rather than being developed separately. While payment rails are slowly being transformed, cryptocurrencies still require traditional rails to facilitate transactions. The rails that have been established for traditional digital transactions are now being developed for web3 cryptocurrency transactions.

1.1 Breaking Down Web3 Payment Rails

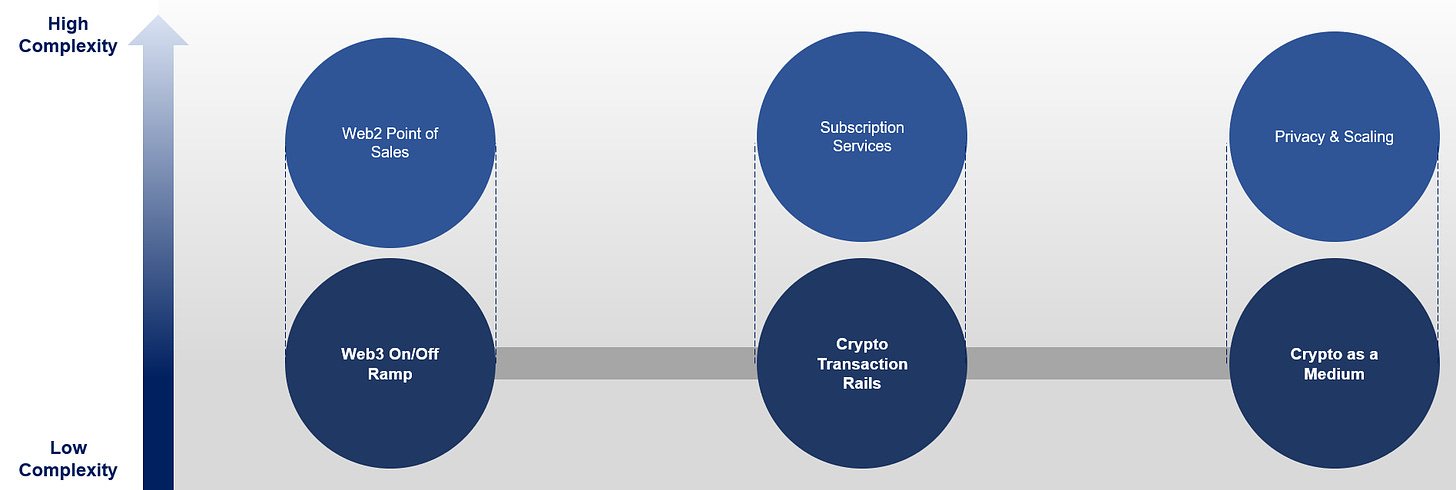

Cryptocurrencies, although a medium of payment by itself, can be considered to be just a part of the entire web3 payments ecosystem. There are other complementing forms that are required for the system to work efficiently.

Web3 On/Off Ramp refers to the facilitation of fiat currencies to cryptocurrencies, and vice versa.

Web2 Point of Sales refers to Web3 On/Off Ramp service providers targeting traditional merchants and brick & mortar companies.

Crypto Transaction Rails refers to the usage of cryptocurrencies within the internal web3 ecosystem, such as interactions with dApps like Uniswap.

Subscription Services refers to the usage of cryptocurrencies to make recurring, fixed transactions.

Crypto as a Medium refers to the usage of cryptocurrencies for its main benefit of instantaneous transactions to facilitate external services.

Privacy & Scaling refers to the infrastructure layer in masking transactions for institutional adoption.

For one to thoroughly understand web3 payments in its current state and form, it is important to break down the system into its individual pieces. This provides a better grasp of what is needed yet still lacking today.

(Note: This article will not cover privacy & scaling. Privacy & scaling has received much recognition and has been covered in excess by many research pieces.)

2.1 Web3 On/Off Ramp - Centralized

Prior to any on-chain cryptocurrency transactions, the most important is to on/off-ramp. As with any pairs of currencies, fiat is needed to be exchanged for cryptocurrencies before it can be traded.

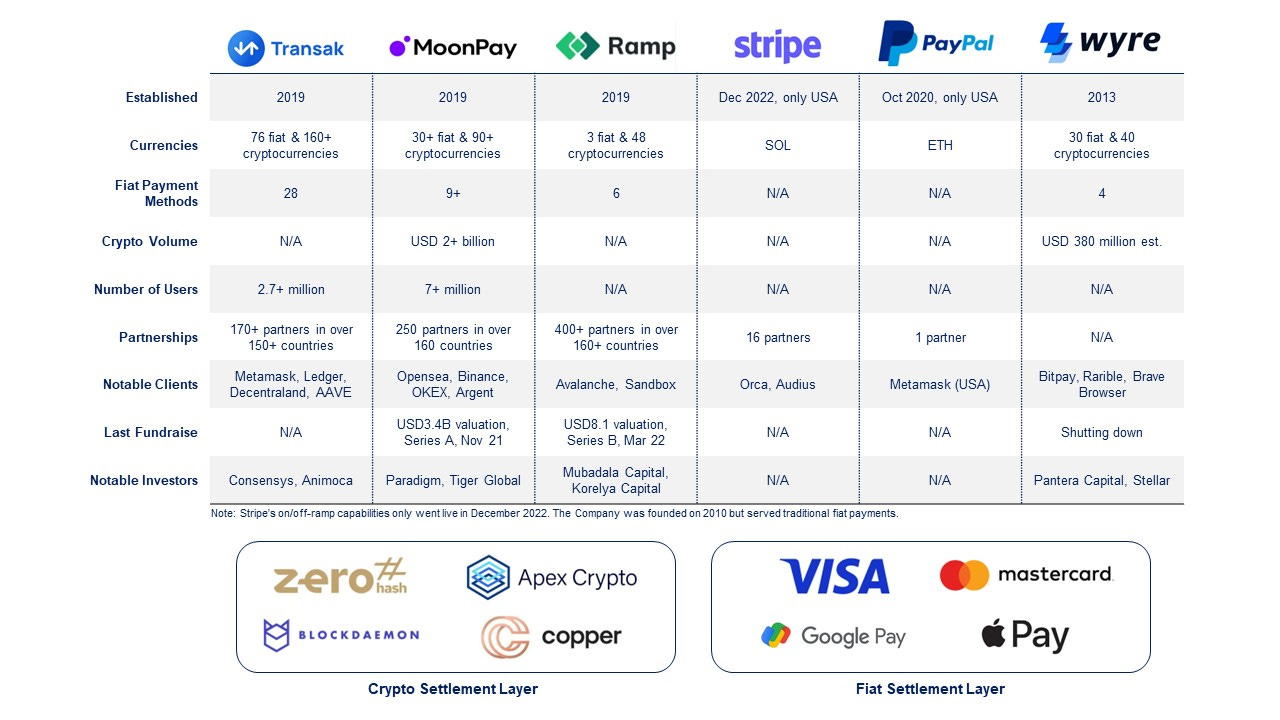

Today, the most common forms of on/off-ramping still lies with central players, due to fierce anti-money laundering regulations. On/off-ramp facilitators such as Transak integrate with web3 and traditional settlement providers to obtain the sufficient licensing to enable individuals with quick and easy access to swap fiat for cryptocurrencies. While they charge a fee and require a degree of KYC, the benefit is in knowing that your cryptocurrencies are facilitated in a relatively clean and safe manner, rather than dubiously.

Being the gateway to cryptocurrencies, it is no surprise therefore that the on/off-ramp vertical is comparatively mature. The sector has transformed into an oligopoly, with most players being in series A and onwards. In December 2022, two of the largest traditional payments company, Stripe and Paypal, also re-ventured into cryptocurrencies, signaling a degree of maturity for the market. While there may be unfortunate exits in the vertical, such as Wyre recently shutting down its operations, these tend to be rare due to the relatively lower costs and high business scalability associated with facilitating transactions.

Due to the interactions with fiat currencies, many of such players are required to obtain Major Payment Institution licenses across geographical locations. (note: The naming can differ based on country.) This slows down the expansion of operations, hampering growth. On the flip side however, this also serves as a moat – an established on/off-ramp would be able to remain ahead of its competitors simply due to its obtained licenses. A prime example would be Stripe and Paypal, where despite their technological readiness and war-chest, are unable to expand rapidly to achieve Transak or Moonpay’s scale.

2.2 Web3 On/Off Ramp - Decentralized

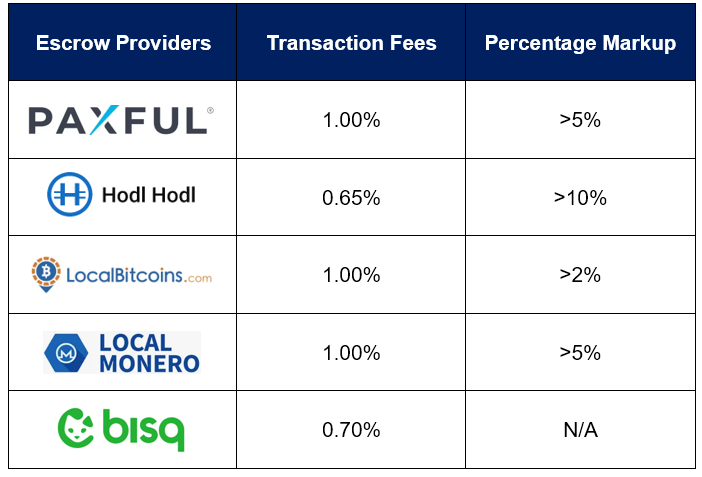

While decentralized forms of on/off-ramping do exist, they typically involve escrow providers. These platforms are non-custodial and facilitate peer-to-peer on/off-ramping with a degree of opaqueness. Besides the absence of KYC, many of these platforms have a large spread due to the illiquidity and premiums associated with the supposed privacy, resulting in less widespread adoption. Additionally, some are geographically restricted due to regulations surrounding their usage.

Paxful, one of the larger decentralized on/off-rampers, cites having more than 6 million users around the world. Yet however, there are only 12,000+ active offers on the platform, demonstrating the low adoption levels. Despite such adoption levels however, the companies operating in such a space are still relatively large, such as Hodl Hodl raising its Series B in October 2021 for an undisclosed amount. The low adoption levels could signify 2 opposing theories: Either that there are still opportunities for decentralized solutions towards on/off-ramping, or that the market is a shrinking dead end due to strict regulations.

Open Banking is a system that provides third-party access to financial data through the use of application programming interfaces (“APIs”).

Another interesting approach towards decentralized on/off-ramping is through the usage of open banking. First introduced by Ramp Network back in 2020, peer-to-peer fiat to cryptocurrency swaps are automated through accessing users’ bank data directly.

When a user wishes to swap fiat for cryptocurrencies, they place an order that flows into Ramp’s pools. A user who wishes to make the opposite transaction can learn and execute upon it automatically via open banking through the pool. The peer-to-peer trade is facilitated in a completely compliant manner, as all users are KYC’d through the banking service provider which Ramp obtains data from through open banking.

While the integration of open banking and on/off-ramping sounds perfect conceptually, the chokepoint arises with the banks. Today, banks are still relatively wary of dealing with cryptocurrencies. This reduces their willingness to open their resources to crypto projects, especially at the point of on/off-ramping. Observed from Ramp’s payment method page, there seems to be only one bank (Easy Bank) that the Company currently supports. This demonstrates the level of difficulty in onboarding banking partners for successful peer-to-peer on/off-ramping.

The difficulty with on/off-ramping, be it centralized or decentralized, again falls back onto regulations. With strict regulations clamping down on the industry, innovations no longer remain the bottleneck towards improvements. Investors should therefore pay more attention towards companies that have proven traction and established licenses for operations, should they wish to gain exposure to this vertical.

3.0 Web2 Point of Sales

Layering a degree of complexity upon web3 on/off-ramps, web2 point of sales are projects targeting to on/off-ramp traditional brick and mortar consumers. Through their services, clients are able to purchase tangible goods and services from traditional merchants using cryptocurrencies.

When it comes to fiat, regulations remain very strict. It is not abnormal for Companies to bypass regulations through working with a licensed service provider or through the acquisition of a provider who already has the necessary licenses in place.

For established companies, this creates a regulatory moat. Investors looking to invest into payment facilitators should take note of the team’s experience in navigating the legal landscape in different geographies.

While the concept might seem similar to on/off-ramp counterparts at first glance, the additional complexity comes in the form of regulations. Point of Sales service providers are required to obtain additional licenses, such as the Payment Processing License (additional to the ones required by on/off-ramp providers), to enable the purchase of tangible items via digital currencies. While this drastically slows down expansion as a result, the upside is that such players are able to provide a full suite of services – from on/off-ramping to custodial wallets. Traditional merchants therefore have a simple, straightforward onboarding process into web3.

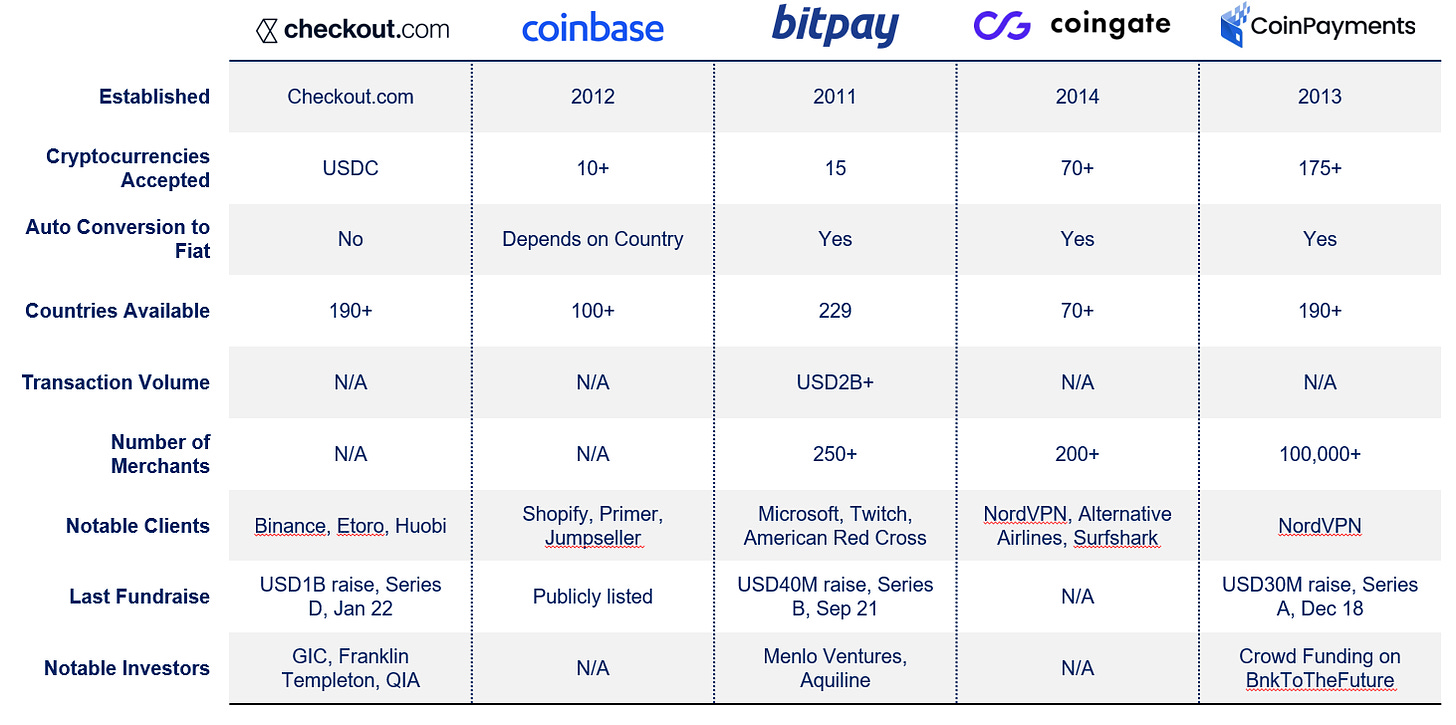

With more than 85% of organizations giving high priority towards adopting cryptocurrencies as an alternative form of payment (as cited in a market study conducted by PYMNTS), it is no surprise that the web2 point of sales market is crowded with large players such as Checkout.com and Coinbase. Working with the assumption that these 85% do indeed implement such payment options, the gap between 46% (the current adoption figure today) and 85% provides a vast market opportunity to capitalize upon.

The concerns of traditional merchants today can be categorized into 3 main areas:

1. Security of the cryptocurrency payment facilitator.

2. Changing regulatory landscape and instability of digital currency market.

3. Complexity of integration with existing traditional infrastructure.

For the first two factors, web2 point of sale service providers who have established traction would most probably be traditional merchants’ first choice. This signals a high barrier to entry for new entrants who have yet to establish a strong clientele. The third factor, however, provides an interesting market opportunity for players in the industry. As traditional merchants favor crypto payment rails that can seamlessly integrate with traditional legacy infrastructure in finance and payments, to prevent too big an overhaul, this indicates that service providers who can take advantage of this niche would be able to see themselves outpacing competitors in the near term. Service providers that can provide an intuitive web2 UI/UX would deliver a strong value proposition.

The large difference between 46% current adoption rate and 85% potential adoption rate as cited in PYMNTS’ industry report demonstrates that the market today is still very viable. New entrants might however find it difficult to breach due to the absence of an established traction – but a specialized niche could potentially bring them to the forefront to drive mass user adoption.

4.0 Transaction Rails

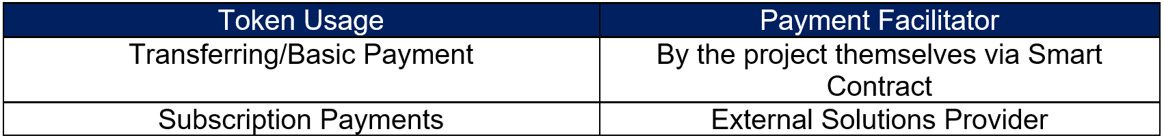

Once on-boarded on-chain via an on/off-ramp, on-chain crypto payment and interactions for web3 dApps, such as games, is relatively straightforward. Most interactions are facilitated in a seamless manner via a Smart Contract developed by the protocol themselves. The complexity comes when a recurring form of payment is required.

4.1 Transaction Rails - Subscriptions

Due to the inherent nature of cryptocurrencies and the signing of transactions, crypto interactions are typically one-off. Recurring transactions are difficult to be facilitated as they require repeated authorization of the transaction.

In August 2018, EIP-1337 was proposed by a team led by Kevin Owocki to enable on-chain subscriptions. Through storing a concatenated bytes hash off-chain till it is needed (which includes input data and signature), transactions can become replay-able, enabling subscription-like payments to be facilitated. While there was some buzz surrounding the proposal, the project eventually stalled and faded away, resulting in no actual production of such an implementation.

As a result of the failure of EIP-1337, numerous projects have therefore attempted to create a workaround to replicate the subscription interface that we so commonly see in web2 today. Most of these solutions involve providing full control of your digital assets to a Smart Contract, thereby overcoming the need for monthly re-signing. As imagined, the level of risks involved with handing over your control to an external Smart Contract can be envisioned to be high. This probably provides an explanation as to why many of the existing projects are still in early stages - complete security is a must for such an immutable Smart Contract. Some examples of players in the market are such as Superfluid (last raised US$9 million in a Seed Round led by Multicoin Capital), Suberra (last raised US$2.7 million in a fundraising Round led by Spartan Labs) and BoomFi (last raised US$3.8 million in a Seed Round led by White Star Capital).

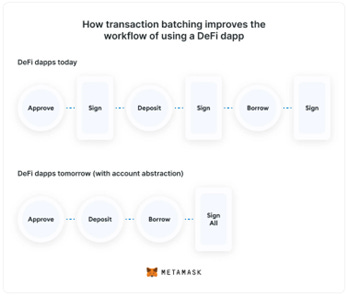

While Smart Contract solutions provided by the aforementioned players are addressing the subscription issue on the developer side, a new Ethereum standard suggests a possibility of a solution from the client side. Deployed in March 2023 on the Ethereum mainnet, ERC-4337 enabled account abstraction on the protocol without any consensus-layer changes – a single contract account can therefore transact with tokens and create contracts at the same time. Through such smart contract accounts, it becomes possible to set up recurring payments and subscriptions.

With account abstraction, smart contract wallets can enable subscription payments from their end, without the need for Smart Contract solutions. Project developers no longer need to introduce their own subscription smart contracts but can rather activate it through the smart contract wallets.

While account abstraction and smart contract wallet players most certainly do threaten smart contract subscription solution providers, it is important to note that the development time for a secure wallet can be envisioned to take a much longer duration, especially due to the level of security required. Therefore this suggests that smart contract subscription solution providers still have a viable market in the near term, but might have to subsequently pivot given the level of innovation occurring on the mainnet.

Given that the wallet market is highly matured, and the facilitation of subscriptions in web2 has traditionally been done in-house (hence not representing a large market), investors should exercise caution when venturing into the space. It is likely that subscription payments will eventually become just one of many features of wallets, rather than a key investable decision maker in the long term.

4.2 Crypto as a Medium

With the instantaneous nature of cryptocurrencies, it is only natural for digital assets to be used as a complementing form of payment rail towards fiat. Today, a number of projects such as Arf utilize cryptocurrencies and/or stablecoins to enable instant money transfers all year round.

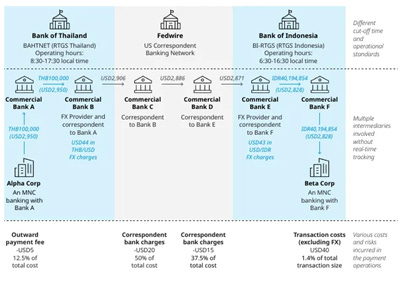

First established in 1973, the Swift Network today facilitates more than half of the international payments occurring across 200+ territories. Despite being costly and slow, the network remains as the dominant choice amongst institutions for cross-border transactions. Financial institutions are unwilling to port over to a new infrastructure mainly due to the network effect.

Many years later, with the introduction of blockchain technology, the network soon found themselves to be slowly disrupted. Ripple, released in 2012 as an open-source protocol, introduced $XRP tokens to facilitate cross-border remittance. The project promised real-time settlement in seconds, compared to days with the Swift Network. Despite the early establishment and the tokens establishing an all-time high market capitalization of US$130.3 billion, the project never truly accomplished its mission statement due to the high volatility of the tokens. Institutions were unable to conduct high value transactions in fear of the fluctuating prices. Additionally, the Ripple Labs were also hit by a lawsuit from the US Securities and Exchange Commission (“SEC”), where the governing entity alleged that the sale of the tokens constituted an unregistered securities offering. The lawsuit ultimately led to the removal of $XRP from several token exchanges and institutional balance sheets.

Today, the regulatory landscape in US remains relatively uncertain with no comprehensive framework established. Firms dealing with cryptocurrencies have expressed frustration at the legal system, stating that they are unable to operate with an ease of mind. The regulatory turmoil has therefore led to the slow adoption of blockchain technology by larger financial institutions, who are even more so unwilling to face any legal issues of sort.

Instead, most of the research towards the usage of blockchains to facilitate instantaneous cross-border remittance are being conducted by central banks, through their development of Central Bank Digital Currencies (“CBDCs”). As of December 2022, 35 Asian nations were reportedly exploring CBDCs. Some, like Project Dunbar and Project Jasper, involve the development of a cross-border multi-currency CBDC (“mCBDC”), addressing the settlement issues of payment rails today.

While the eventuality of CBDCs seems certain, it is critical to note that there are multiple outstanding issues to consider before the issuance of CBDCs, ranging from privacy to money laundering. As such, we can expect CBDCs to only arrive in the medium to long term. Additionally, there are many variables to consider for a CBDC future – for example, the underlying infrastructure could be either permissioned or permissionless chain, or the issuer could range between the central bank itself or a private issuer, like Circle. This makes it hard to gauge in what form CBDCs will exactly take shape.

With that in mind, the highly complex future for CBDCs gives near term opportunities to cross-border facilitators such as Arf. Navigating away from these complexities, such players utilize existing forms of cryptocurrencies, most commonly stablecoins such as USDC, to facilitate instantaneous cross-border remittance. These enable money service businesses to free up locked up liquidity set aside for money transfers, enabling more efficient capital management.

Due to the interactions between fiat currencies, regulations are once again highly strict within the cross-border remittance sector. In certain countries, geographical licenses are required before the cross-border remittance service provider can operate in the jurisdiction. As such, there are not as many players in the vertical, due to the need for multiple license acquisition.

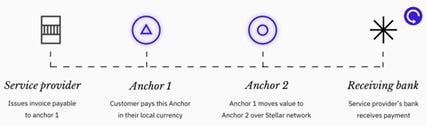

One of the biggest players in cross-border remittance is Stellar Foundation, which is a non-profit organization set up in 2014. The Company has assisted a number of existing players, such as MoneyGram, to enable instantaneous settlements through their set of APIs and SDKs.

Founded by Jed McCaleb, the co-founder of Ripple, Stellar enables cross-border remittances by being the backbone infrastructure for companies to set up their own forms of digital currencies via their protocol. Companies can utilize Stellar as the underlying blockchain to facilitate instantaneous digital currency transfers, with the digital currencies being redeemable for its value by the issuer. (ie. off-ramping)

While Stellar’s infrastructure does facilitate a seamless cross-border remittance network on paper, the reality is that the establishment of such a network is resource heavy. Organizations interested in utilizing Stellar are required to have multi-national presence and the necessary resources to reserve back the newly created digital currency. This leads to unnecessary and inefficient capital lockup and high expenditure in maintaining the remittance network. As a result, while Stellar has been an infrastructure of choice for cross-border remittance, the foundation’s solutions are mainly adopted by large established players, rather than small shops.

Overall, despite being one of the lowest hanging fruits, cross-border remittance still remains largely unsolved by cryptocurrencies. The vertical is still a mix between in-house solutions facilitated by Stellar, third-party solutions and Central Bank initiatives. Given the current convoluted regulatory landscape, investors can expect it to remain as such in the near to medium term. Private and public players still have the opportunity to grow amidst this climate.

5.0 Conclusion

Cryptocurrencies continue to innovate the financial services sector that we know of today. Despite the obvious use cases, the regulatory and legal landscape has provided much hindrance towards development of a more seamless payments infrastructure. The lowest hanging fruits such as instantaneous cross-border remittances are still not achieved, leaving much room for investors to capitalize upon. Certain sectors, such as subscription payments, are teeming with innovation that makes it complex yet exciting to navigate within.

Investors should therefore continue to pay close attention to the development of the payments sector, especially with regards to the applications of blockchain into these verticals.